Cryptocurrency regulation has emerged as a pivotal topic in the financial landscape, influencing how digital assets are perceived and managed within global markets. The recent introduction of comprehensive crypto legislation seeks to redefine the framework governing these assets, offering clarity on whether they qualify as commodities or securities. Notably, this shift in regulation is accompanied by increased SEC oversight, aiming to establish a more robust mechanism for monitoring the rapidly evolving crypto market. As investors and stakeholders eagerly await the latest crypto market news, it’s essential to understand the nuances of stablecoin regulation as it unfolds. With leading financial institutions backing the regulatory efforts, the future of cryptocurrency promises not only innovation but also stronger governance.

The realm of digital currency is witnessing unprecedented changes as regulatory bodies work to establish clear guidelines for asset classification and exchange operations. This movement towards thoughtful governance of virtual currencies is crucial for facilitating secure transactions while fostering industry growth. Recent proposals by lawmakers emphasize the need for balanced oversight and a deep understanding of emerging technologies associated with cryptocurrencies. Furthermore, the evolving narrative around stable digital currencies presents both opportunities and challenges for regulators and market participants alike. As these developments continue to unfold, the importance of regulatory clarity can not be overstated, determining the trajectory of the evolving digital finance landscape.

The Impact of Cryptocurrency Regulation on Market Dynamics

The recent developments in cryptocurrency regulation are significantly influencing the market dynamics of digital assets. With the Senate Banking Committee’s proposed legislation aimed at limiting the SEC’s oversight, stakeholders are optimistic about a more defined and supportive framework for cryptocurrencies. This legislative shift could lead to a climate where innovations in the crypto space, particularly in blockchain technology and stablecoin development, can thrive under a clearer regulatory environment, potentially aligning the U.S. more closely with global standards.

Moreover, as cryptocurrencies like Bitcoin and Ether witness substantial price movements, driven by external geopolitical factors such as the ceasefire announcement between Israel and Iran, the intertwining of crypto market news and regulatory updates becomes paramount. Investors are increasingly paying attention to how proposed bills can affect the valuation of digital assets and the operational landscape for crypto exchanges seeking regulatory clarity.

Frequently Asked Questions

What are the latest developments in cryptocurrency regulation related to SEC oversight?

Recent proposals by the Senate Banking Committee aim to limit the SEC’s oversight on digital assets, marking a shift towards clearer crypto legislation. This includes defining digital assets as either commodities or securities, which will significantly impact how cryptocurrencies are regulated.

How does the proposed legislation impact the crypto market news regarding digital assets?

The proposed legislation is crucial for the crypto market as it seeks to establish regulatory guidelines that could enhance investor confidence. By allowing crypto exchanges to register with the Commodity Futures Trading Commission, it enables a more structured environment for digital assets.

What does the new stablecoin regulation entail?

The recently approved stablecoin bill focuses on regulatory oversight for stablecoins, prohibiting yield-bearing consumer stablecoins. This legislation marks a significant milestone in crypto regulation, as it provides guidance on how stablecoins should be treated within the financial system.

How are investment firms reacting to cryptocurrency regulation changes?

Investment firms like Goldman Sachs and Citadel Securities are increasingly engaging in the cryptocurrency space, viewing the proposed regulations as a positive step. The influx of $135 million in funding for Digital Asset indicates strong interest from major financial institutions in regulated crypto products.

Why is the clarity of crypto legislation important for the future of digital assets?

Clear crypto legislation is vital for the future of digital assets as it establishes a framework that promotes innovation while protecting investors. It allows the U.S. to enhance its competitive stance in the global crypto market, which is crucial for attracting investments and fostering growth.

What role does the Senate Banking Committee play in shaping crypto legislation?

The Senate Banking Committee plays a pivotal role by proposing and drafting legislation aimed at regulating cryptocurrencies. Their recent efforts to define digital assets and limit SEC oversight are steps toward establishing comprehensive guidelines in the crypto sector.

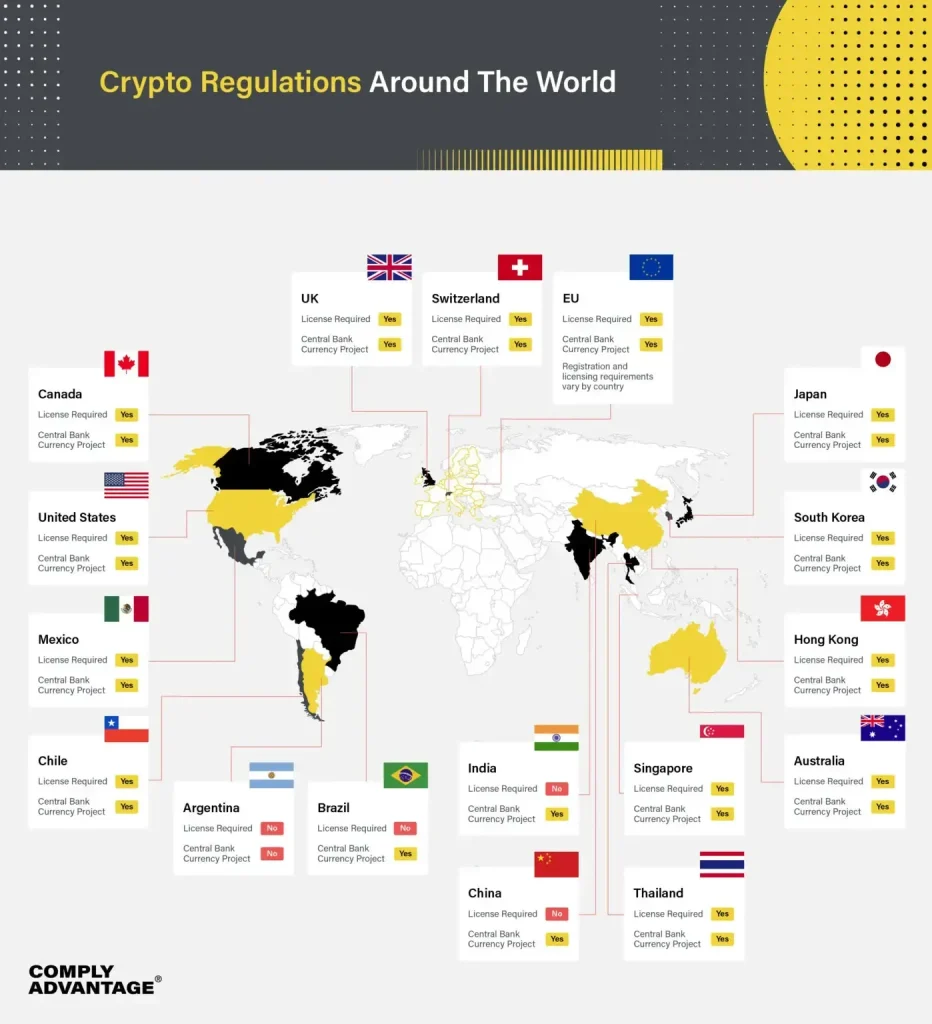

How does the current state of crypto legislation compare to international standards?

Current U.S. crypto legislation is seen as reactive compared to more established regulations in Europe. Experts like Robinhood CEO Vlad Tenev suggest that the U.S. needs to strengthen its regulatory framework to maintain leadership in the global digital asset market.

What are the implications of the Senate’s proposed bill on cryptocurrency exchanges?

The Senate’s proposed bill allows crypto exchanges to register with the Commodity Futures Trading Commission, which could streamline operations and provide clearer governance for cryptocurrency trading. This regulatory clarity can boost investor confidence and participation in the crypto market.

| Key Points |

|---|

| Bitcoin surpassed $105,000, ether above $2,400, XRP at $2.19. |

| Ceasefire announcement between Israel and Iran boosted market sentiment. |

| Senate Banking Committee proposed legislation to limit SEC’s oversight of digital assets. |

| Legislation defines when crypto is a commodity vs. security and allows registration with CFTC. |

| Tenev asserts U.S. must regain leadership in crypto against Europe. |

| Senate stablecoin bill approved, marking a legislative victory for crypto industry. |

| Digital Asset raised $135 million in funding to enhance blockchain adoption. |

Summary

Cryptocurrency regulation is becoming increasingly crucial as major legislative developments take shape in the U.S. The recent proposal from the Senate Banking Committee could redefine the landscape of digital assets, with significant implications for how cryptocurrencies are classified and regulated. As Bitcoin, ether, and XRP continue to gain momentum, the support from influential financial institutions signals a growing recognition of the importance of structured regulation within the tech-driven financial sector.