Cisco earnings beat expectations as Cisco earnings per share came in at 99 cents. Revenue reached $14.67 billion, slightly above the $14.62 billion analysts expected. The quarter showed Cisco revenue growth of 7.6% year over year. Cisco networking revenue totaled $7.63 billion, up 12% from a year earlier. The company issued Cisco 2026 guidance of $4 to $4.06 in adjusted earnings per share and $59 billion to $60 billion in revenue.

From a broader lens, the latest quarterly show of strength points to ongoing momentum in Cisco’s enterprise technology lineup. Analysts are watching how Cisco capitalizes on Cisco AI infrastructure investments and strategic partnerships to expand its AI-enabled networking capabilities. The tone of the guidance reinforces a steady growth path for Cisco revenue and earnings into 2026.

Cisco earnings beat propels stock momentum and sets tone for 2026 guidance

Cisco reported results that narrowly beat analysts’ expectations, with a 99 cents per share adjusted earnings figure topping the 98-cent consensus and revenue of $14.67 billion above the $14.62 billion forecast. The company also posted a 7.6% year-over-year revenue increase for the quarter ending July 26, signaling ongoing demand in its enterprise networking and security portfolios.

Management signaled cautious optimism by guiding for 97 to 99 cents of adjusted EPS on $14.65 to $14.85 billion in revenue for the fiscal first quarter, which aligns with, and in some cases exceeds, the LSEG consensus. The beat underscores Cisco’s ability to translate product cycles and AI-related initiatives into pro-forma profitability as macro headwinds persist.

Cisco earnings per share: a closer look at the 99-cent adjusted beat

Cisco earnings per share (EPS) came in at 99 cents, a touch above the 98-cent consensus, reflecting a disciplined cost structure and steady mix shift toward higher-margin software, security, and AI-enabled offerings.

This EPS outperformance adds to the quarterly revenue strength and supports investor confidence in Cisco’s ability to sustain margin expansion as it executes its AI infrastructure investments.

Cisco revenue growth drivers in the quarter: networking and security contributions

The quarter highlighted a 7.6% year-over-year revenue growth to $14.67 billion, with networking revenue at $7.63 billion, up 12% year over year, reflecting robust enterprise demand.

Security revenue rose to $1.95 billion, up 9% but below the StreetAccount estimate of $2.11 billion, signaling a mixed performance within the security segment while overall revenue growth remains healthy.

Cisco AI infrastructure investments to reshape enterprise networks

Cisco’s AI infrastructure push included orders from web companies totaling $800 million in the quarter, contributing to a yearly total above $2 billion in 2025.

The company also flagged partnerships with BlackRock, Microsoft, and others, and joined the Stargate data center initiative with OpenAI and SoftBank to drive AI-friendly hardware and software ecosystems, while introducing switches and routers designed to run AI workloads.

Cisco 2026 guidance: investor expectations and the road ahead

For fiscal 2026, Cisco forecasts adjusted EPS of $4.00 to $4.06 and revenue of $59 billion to $60 billion, with the Street consensus at about $4.03 per share and $59.53 billion in revenue.

Analysts will watch how tariffs and other macro factors influence the cadence of products and services as Cisco navigates a complex environment while pursuing programmatic AI infrastructure deployments.

Strategic focus on sovereign infrastructure and GPU licensing

The company discussed planning phases on sovereign infrastructure projects, noting that it has not yet taken orders but is actively collaborating on licenses for GPUs as governments explore GPU-enabled networks.

This strategic posture suggests future government-related opportunities could become a meaningful tailwind if approvals and regulatory environments align with Cisco’s data center and AI network capabilities.

Cisco networking revenue resilience and growth trajectory

Back to networking, Cisco’s quarterly networking revenue was $7.63 billion, up 12% year over year, outpacing expectations and underscoring the segment as a durable growth engine.

The continued strength in networking signals Cisco’s ability to monetize enterprise networking upgrades even as AI ecosystems mature and cloud providers demand more on-prem and hybrid networking architectures.

Partnerships and ecosystems fueling Cisco AI infrastructure strategy

The announcements of collaborations with BlackRock, Microsoft, and others, plus the Stargate Middle East data center initiative with OpenAI and SoftBank, position Cisco within a broader AI infrastructure ecosystem.

These partnerships, combined with product introductions that support AI workloads, are intended to expand the AI infrastructure sales pipeline and help Cisco translate AI demand into durable revenue growth.

Tariffs and macro environment: Cisco’s management insights

Cisco’s CFO, Mark Patterson, noted that while there is clarity on tariffs, the company continues to operate in a complex environment that influences planning and cost structures.

Executives emphasized disciplined execution and a focus on high-value AI-enabled offerings to navigate tariff uncertainties and supply chain volatility.

Market reaction and investor sentiment after earnings

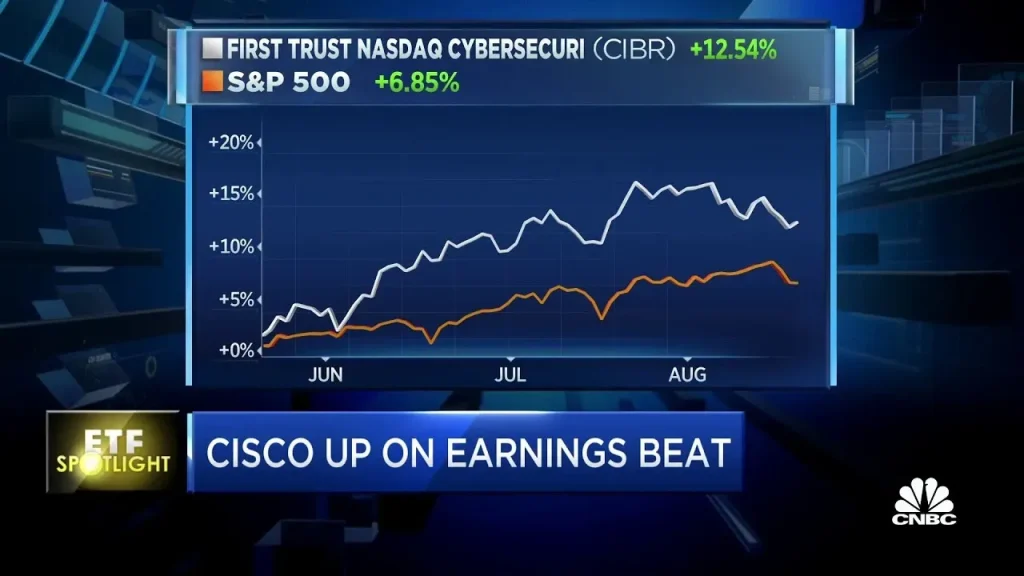

As the quarter closed, Cisco shares rose meaningfully in 2025, up about 19% versus a 10% gain for the S&P 500, reflecting investor optimism around the earnings beat and AI-led growth prospects.

With solid EPS and revenue performance and an upbeat 2026 guidance framework, investors are likely to price in continued outperformance as Cisco scales AI infrastructure initiatives.

AI workloads and product design: from switches to routers

Cisco introduced switches and routers capable of handling AI workloads, enabling customers to run AI inference and compute-intensive tasks closer to the data, reducing latency and boosting performance for enterprise AI deployments.

This hardware capability complements the company’s software and security offerings while contributing to Cisco’s overall AI infrastructure strategy.

Future-oriented view: scaling AI and data center capabilities for long-term growth

With a multi-year pipeline in the hundreds of millions for enterprise AI infrastructure and a growing focus on OpenAI-like ecosystems, Cisco is positioning itself to capitalize on AI-driven networking demands.

The forecasted 2026 trajectory, along with ongoing AI partnerships and sovereign infrastructure conversations, suggests Cisco aims to turn AI-enabled networking into a sustained revenue driver.

Frequently Asked Questions

What was Cisco earnings per share and revenue result in the latest quarter?

Cisco posted an earnings beat with adjusted earnings per share of 99 cents, versus 98 cents expected, and revenue of $14.67 billion versus $14.62 billion expected. Revenue rose 7.6% year over year, with net income of $2.82 billion (71 cents per share). Management guided for the next quarter above consensus.

How did Cisco revenue growth look in the latest quarter?

Cisco revenue growth for the quarter was 7.6% year over year to $14.67 billion. Networking revenue rose 12% to $7.63 billion, while security revenue was $1.95 billion, up 9%.

What is Cisco 2026 guidance after the earnings beat?

For fiscal 2026, Cisco provided adjusted earnings per share guidance of $4.00 to $4.06 and revenue guidance of $59 billion to $60 billion, in line with or modestly above the LSEG consensus of about $4.03 and $59.53 billion.

What does Cisco AI infrastructure strategy reveal after the earnings beat?

Cisco AI infrastructure strategy includes collaborations with BlackRock, Microsoft and others to invest in AI infrastructure, and participation in the Stargate data center initiative for the Middle East with OpenAI and SoftBank. The company introduced AI workload capable switches and routers, with AI infrastructure orders from web companies totaling $800 million in the quarter and the 2025 AI infra orders exceeding $2 billion.

How did Cisco earnings per share compare to expectations in the quarter?

The quarter delivered adjusted earnings per share of 99 cents, topping the consensus of 98 cents per share.

How did Cisco networking revenue perform in the quarter?

Networking revenue was $7.63 billion, up 12% year over year, well above StreetAccount estimates of about $7.34 billion.

What did management say about tariffs and the macro environment affecting Cisco revenue growth and AI infrastructure initiatives?

Management said there is some clarity on tariffs but the macro environment remains complex; the company is pursuing sovereign infrastructure projects and continuing to advance AI infrastructure initiatives, with no firm orders yet in that area.

How did investors react to Cisco’s earnings beat, and what does it imply for Cisco 2026 guidance?

Investors reacted positively, with Cisco shares up about 19% in 2025, as the earnings beat and the 2026 guidance contributed to a more favorable sentiment around the company’s outlook.

| Aspect | Key Points |

|---|---|

| Quarterly results vs expectations | EPS 0.99 adjusted vs 0.98 expected; Revenue $14.67B vs $14.62B; Revenue up 7.6% YoY; Net income $2.82B (71c) vs $2.16B (54c) prior year. |

| Q1 fiscal guidance | Guidance: 97–99c EPS on $14.65–$14.85B revenue; LSEG consensus: 97c and $14.62B. |

| Full-year 2026 guidance | EPS $4.00–$4.06; Revenue $59–$60B; LSEG consensus $4.03 and $59.53B. |

| Management commentary | Tariffs clarity exists but environment described as complex (Mark Patterson). |

| Q4 networking revenue | $7.63B, +12% YoY; StreetAccount forecast $7.34B. |

| Q4 security revenue | $1.95B, +9%; StreetAccount $2.11B. |

| AI initiatives & partnerships | Collaborations with BlackRock, Microsoft and others to invest in AI infrastructure. |

| Stargate & AI collaborations | Stargate data center initiative for the Middle East with OpenAI and SoftBank. |

| AI hardware & planning | Switches/routers that support AI workloads; sovereign infrastructure planning; licenses for GPUs in progress. |

| AI orders & pipeline | AI infrastructure orders in the quarter: $800M; 2025 total >$2B; ~A$1B for back-end GPU networks; enterprise AI pipeline in the hundreds of millions. |

| Market activity | At market close Wednesday, shares up 19% in 2025; S&P 500 up ~10%. |

Summary

Table of key points from Cisco earnings report; highlights include EPS and revenue beats vs. expectations, guidance figures, AI initiatives, and stock performance.